EPA

EPA

INDIA WHEAT EXPORT BAN: WHY IT MATTERS TO THE WORLD

BY: SHRUTI MENON - BBC REALITY CHECKSITE: BBC

TRENDING

Activism

AI

Belief

Big Pharma

Conspiracy

Cult

Culture

Economy

Education

Entertainment

Environment

Faith

Global

Government

Health

Hi Tech

Leadership

Politics

Prophecy

Science

Security

Social Climate

Universe

War

India has defended its decision to ban wheat exports after criticism that it could worsen the global food supply situation in the wake of the Ukraine war.

"If everyone starts to impose export restrictions... that would worsen the crisis," German Food and Agriculture Minister Cem Ozdemir said after the ban was announced in May.

But India's Commerce Minister, Piyush Goyal, says the export ban should not affect global markets because it is not a major wheat exporter.

So what has been the impact of India's move?

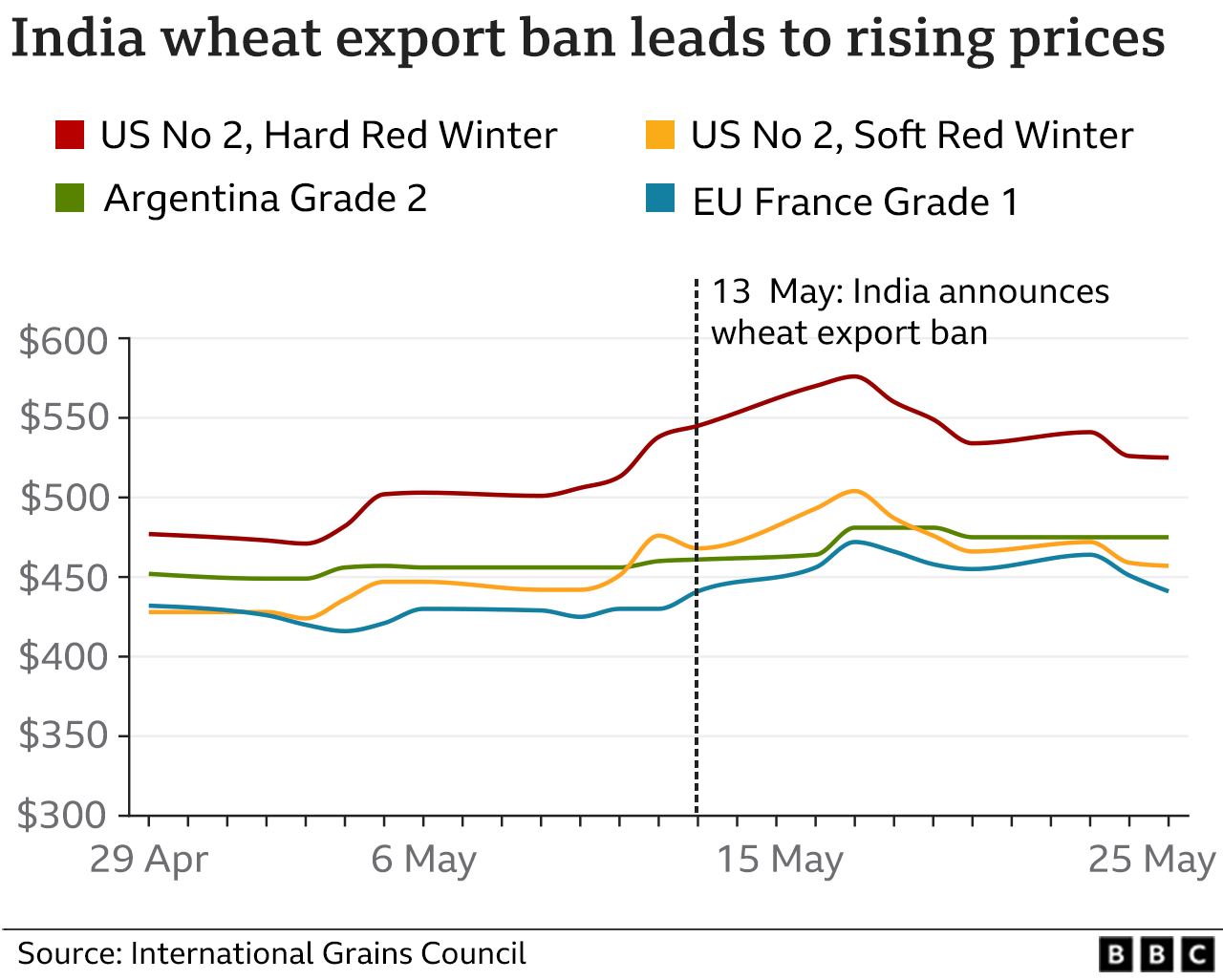

Global wheat price rise

India's ban was announced on 13 May, after unseasonably hot weather affected the wheat crop, sending local prices soaring.

Although India is not a major wheat exporter, the move unsettled global markets with the Chicago benchmark wheat index rising by nearly 6%.

The prices of some of the main types of wheat rose for several days, peaking on 17 to 18 May.

Wheat prices had risen throughout March and April after the Russian invasion of Ukraine, as had the prices of other foodstuffs.

Disruption caused by the war means that millions of tonnes of wheat have been unable to leave Ukraine, which is one of the world's biggest exporters.

Kelly Goughary, of the agriculture data research group Gro Intelligence, explains that India's ban led to a further price surge because "global buyers were depending on supplies from India after exports from the Black Sea region plunged".

Who's been affected by India's ban?

India is the world's second biggest wheat producer, but accounts for less than 1% of the global wheat trade. It keeps a lot of it to provide subsidised food for the poor.

But just before announcing the ban, India was aiming to boost exports by shipping a record 10 million tonnes of wheat this year - compared with just two million last year.

It was offering supplies to new markets in Asia and Africa, and even after the ban, several countries said they were in touch with India to keep exports going.

Image source Getty - India had been trying to boost wheat export

India says some countries will still receive wheat exports, and that it will "continue to assist neighbours in their hour of need."

Its top export markets are Bangladesh, Nepal and Sri Lanka - as well as the United Arab Emirates (UAE).

In 2019-20, Sri Lanka and UAE imported more than 50% of their wheat from India, according to the Observatory of Economic Complexity (OEC), and Nepal imported more than 90%.

It is not yet clear whether these countries will still get Indian wheat under existing contracts, or will receive supplies under future deals.

However, Egypt says that government purchases of Indian wheat will continue. It's one of the biggest importers of wheat globally.

The International Monetary Fund has called on India to reconsider the export ban, saying it could play a significant role in helping alleviate the current wheat supply crisis for those countries most affected by the war in Ukraine.

Bad weather and fertiliser prices

Apart from the war in Ukraine, the weather has had an impact in some major wheat-exporting countries.

"Drought, floods and heat waves threaten crops in some other major producers [US, Canada and France]," says Kelly Goughary of Gro Intelligence.

Image source - Getty Images - China is the world's largest producer of wheat

Global wheat production for the 2022-23 period will be the lowest for four years, and global stocks of wheat are predicted to be at their lowest for six years, according to a US government report .

Gro Intelligence also points out that global fertiliser prices have tripled over the past year, risking "significant" reductions in crop yields this year.

It estimates that this - together with other factors - means global wheat stocks are down to their lowest level since the 2008 financial crisis.

China - the world's largest producer of wheat for its huge population - said in March that its winter crop could be the "worst in history" because of heavy rainfall in 2021.

There is still uncertainty about the actual state of the harvest, and whether or not it will be badly affected.

But if it is, China may want to buy on global markets to build up its stocks, further tightening global supplies and pushing up prices.

Click 3 Dots Below to View Complete Sidebar