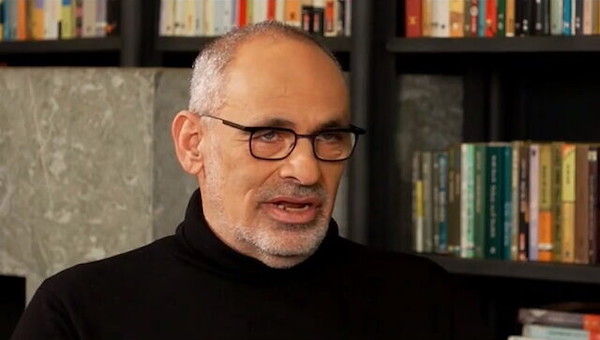

SHLOMO DOVRAT SPEAKS TO CHANNEL 12 NEWS ON FEBRUARY 24, 2023. (SCREENSHOT: CHANNEL 12)

ISRAEL: ECONOMY ‘IN TERRIBLE DANGER,’ OVERHAUL CRISIS MUST BE SOLVED IN DAYS

BY: TOI STAFFORIGINAL SITE: TIMES OF ISRAEL

TOPICS

Activism

AI

Belief

Big Pharma

Conspiracy

Cult

Culture

Economy

Education

Entertainment

Environment

Faith

Global

Government

Health

Hi Tech

Leadership

Politics

Prophecy

Science

Security

Social Climate

Universe

War

Shlomo Dovrat, whose company manages over $1.3 billion in tech, says he has ‘never seen such concern among foreign investors,’ warns billions of dollars leaving Israel every day.

One of Israel’s top tech investors warned in an interview aired on Friday night that the country must solve its internal crisis over the government’s judicial overhaul “within days,” saying the Israeli economy was “in terrible danger.”

Speaking to Channel 12 news, Shlomo Dovrat, who is a co-founder and general partner at Viola Ventures, an Israeli venture capital fund with over $1.3 billion under management, said he was “deeply anxious” about the government’s judicial plans.

“I believe we’re in a dangerous moment, the likes of which I don’t remember seeing in many years,” he said.

Dovrat, who according to Channel 12 has not given an interview in 20 years, broke his silence due to his intense worry.

“Over a period of 40 years we built a glorious economy, a spectacular high-tech industry,” Dovrat said, but the government’s plans were leading to “a danger” for the economy and society “at a level I don’t remember seeing.”

“We are seeing the risk premium for investments in Israel rising dramatically,” he said, noting that money was leaving Israel , and a large part of it would likely not return.

According to Dovrat, foreign investors “won’t invest in a country that doesn’t have certainty, that doesn’t have political stability and doesn’t have an independent justice system that can protect their property rights.”

He said Netanyahu “must take action fast.”

“The markets are voting with their feet. Billions of dollars are exiting Israel every day… In boards of companies we’re invested in, foreign investors say ‘Israel’s risk is too high now, get the money out of Israel.’ That’s what we’re hearing, not from one or two [companies]. It’s widespread,” he said.

Some Israeli tech companies have said they are planning to move their operations out of the country over the overhaul plans.

“Every day that passes and this crisis isn’t resolved we are at huge risk. The clock is ticking. We have to act and fast,” Dovrat said.

“The moment the high-tech industry leaves Israel or the economy weakens in general and foreign investors stop coming here — the cost of living will rise dramatically, interests on mortgages will rise dramatically,” he said.

He called Israel’s high-tech industry “Israel’s economic miracle,” making up 45% of exports and nearly 20% of GDP “and a huge percentage of revenue from taxes.”

“We won’t have the money for hospitals, infrastructure, health,… and of course security,” he warned.

“We don’t have time for politics… [It] can’t end in months of negotiations and a compromise at the last minute. If this process lasts months, there won’t be anything left to fix,” he said, adding that he had “never seen such concern among foreign investors.”

Dovrat also called on President Isaac Herzog to seek a compromise “within days.”

“They must act immediately. Not deliberations, not negotiations, not a pause, no preconditions. No ego games, no power games. An agreement within days. There’s no time. We’re in terrible danger,” he said.

Dovrat’s interview came after a Thursday report said Bank of Israel Governor Amir Yaron warned ministers that an economic crisis could break out at any moment, amid mounting concerns over the government’s pursuit of sweeping changes to the judiciary, which has spooked investors and entrepreneurs in recent weeks and sparked fears of an economic downturn.

Yaron and the Finance Ministry’s chief economist Shira Greenberg were asked for their observations Thursday on the potential harm to the economy at the discussion session by Economy Minister Nir Barkat, who also reportedly relayed warnings he had heard directly from figures in the tech and business industry of serious economic fallout.

“A snowball [effect] may begin,” Greenberg reportedly responded, adding that there was “significant danger” to the economy. Earlier, Greenberg warned in a report accompanying the multi-year budget draft 2024-2027 sent to Prime Minister Benjamin Netanyahu’s hardline coalition government on Thursday that the judicial overhaul was “perceived by the market as damaging the strength and independence of state institutions and increases uncertainty in the investment environment.”

“This may harm economic activity and in particular private investments,” she wrote.

Netanyahu has repeatedly waved off such warnings, including on Thursday when he said those making them were driven by political motivations and hysteria and insisted they would be proven wrong.

In her report, Greenberg cited studies that found a positive relationship between the strength and independence of state institutions and economic growth, scope of private investments, and in particular the scope of foreign direct investments.

“Also, the credit rating agencies are likely to react to these developments,” Greenberg cautioned.

According to a separate report Thursday by Israeli data and credit firm BDI, one in five large companies based in Israel has seriously considered moving money out of the country or has already done so. The study, cited by Channel 12, surveyed more than 900 companies across sectors such as tech and real estate, with almost 60% reporting that their revenues took a hit from recent market jitters and a weaker shekel that makes imported goods more expensive and hikes consumer prices.

As the government passed initial votes on legislation this week marking the first significant steps in its divisive effort to shake up the judiciary, the shekel depreciated to the weakest level in three years against the US dollar and Tel Aviv shares declined .

The vote came despite fierce opposition and massive protests against the government’s plans, which would grant it total control over the appointment of judges, including to the High Court, all but eliminate the High Court’s ability to review and strike down legislation and allow politicians to appoint — and fire — their own legal advisers.

Over the past month, the shekel has lost over 7% of its value amid the mass protests and the dampened market mood.

In his comments at the discussion session on the state budget, Barkat — a former tech entrepreneur and venture capitalist who is a member of the ruling Likud party — relayed warnings of serious economic fallout by leading Israeli business figures whom he said told him that the government “can shred the budget” as it “won’t have the money to implement it anyway.”

“The Israeli economy is going to crash,” he said he was told.

Barkat said he was in favor of the judicial overhaul but urged for negotiations and dialogue. “Even if we don’t get everything we are after, it won’t be so terrible,” he reportedly said.

At the session, Finance Minister Bezalel Smotrich, whose far-right Religious Zionism party is one of the driving forces behind the shakeup of the judiciary, said the hard-right government has taken into account that things “may develop in negative directions” with a drop in government revenues. “Therefore we need to be responsible with the budget,” Smotrich was quoted as saying.

The budget discussion session came days after the central bank hiked its key lending rate to the highest level since 2008 , as it seeks to battle inflation and a weakening shekel.

Yaron reportedly called an emergency meeting late Wednesday to discuss stabilizing the country’s financial picture after this week’s market rollercoaster.

On Wednesday, former Bank of Israel chief Jacob Frenkel joined a growing list of economists inside and outside Israel to sound the alarm over the judicial overhaul.

Frenkel, who served as bank governor from 1991 to 2000, urged the government in an interview with Channel 12 on Wednesday to rethink its plans, warning that “irresponsible decisions could ruin it all.”

“We have a situation of total uncertainty: economic uncertainty, political uncertainty and a lack of certainty in institutions, which affects all aspects of the economy,” he said.