THE 6 COMPANIES THAT OWN (ALMOST) ALL MEDIA [INFOGRAPHIC]

WEBFX TEAM

In modern America, it feels like you have an unlimited variety of entertainment and media options right at your fingertips.

Television, film, and video game companies seem to come out of the woodwork in today’s startup-centric economy. Who knows what they’ll do next? But while it may seem like you have limitless options, most of the media you consume is owned by one of six companies. These six media companies are known as The Big 6.

While independent media outlets still exist (and there are a lot of them), the major outlets are almost all owned by these six conglomerates. To be clear, “media” in this context does not refer just to news outlets — it refers to any medium that controls the distribution of information. So here, “media” includes 24-hour news stations, newspapers, publishing houses, Internet utilities, and even video game developers.

With that in mind, let’s take a look at each of The Big 6, who control them, and what they own.

Media Conglomerate #1: National Amusements

Unless you’re directly involved in business and / or entertainment, you’ve probably never heard of National Amusements before.

The company owns movie theaters throughout the world — about 950 total — but it owns much more than just movie theaters.

NA’s huge collection of properties is staggering. Whether they own a company entirely, possess majority shares, or even own minority voting shares, the scope of NA’s reach is enormous for a company that’s known less than its subsidiaries.

To start our look at NA, let’s check out one of the biggest names in modern business — Sumner Redstone.

Head: Sumner Redstone

Sumner Redstone is the current owner of National Amusements and all of its properties. While his daughter Shari has the title of President, Sumner Redstone retains most of the control over the company.

NA was first founded by Sumner Redstone’s father Michael Redstone, making National Amusements one of the most powerful and successful corporate dynasties in the United States.

None of the Redstones publish their salaries. After all, National Amusements is a private company.

However, finance experts can guess at Sumner Redstone’s overall net worth.

His net worth refers to the total financial value of what Sumner Redstone owns, minus any outstanding debts.

As he nears his 94th birthday in 2017, Sumner Redstone (and his estate) is worth an estimated $4.6 billion, according to Forbes.

TV and Film Assets

The most famous assets of National Amusements are almost all Viacom and CBS properties.

Combined, they make up the lion’s share of NA’s television and film acquisitions.

Print Assets

National Amusements has a modest collection of print publishers, but they’re pretty well-known.

The most well-known is Simon and Schuster, which National Amusements acquired when it purchased Viacom in 1999.

Video Game Assets

Along with other entertainment assets, National Amusements controls CBS Games.

Since its acquisition, CBS Games has rebranded to CBS Interactive, which now controls well-known gaming websites that we’ll look at next.

Internet Assets

With CBS Interactive, National Amusements controls giant chunks of the video game news and sports news industries.

These brands include GameSpot, Metacritic, c|net, and 247-Sports.

Media Conglomerate #2: Disney

Disney is probably the most well-known media name on this list.

The company has a hand in just about every medium in the world from children’s cinema to sports.

When it comes to television and film, there’s a good chance you’re watching something owned by the Disney company — even if it doesn’t have Disney’s name.

Why?

They own so, so much.

Let’s start with the company’s leader.

Head: Bob Iger

Disney announced Bob Iger as CEO on March 13, 2005, following the departure of Michael Eisner.

Since then, Iger has run a campaign of mergers and acquisitions to expand Disney into an even greater media powerhouse, especially with the acquisition of Marvel ($4 billion) and Lucasfilm ($4 billion).

His published salary is $44.9 million. That breaks down to:

- $1.73 million per paycheck

- $172,692.32 per day

- $21,586.54 per hour

He (technically) oversees all of the following companies.

TV and Film Assets

First, let’s look at the bread and butter of Disney — television, and film.

Considering they have theme parks built to their entertainment assets, it’s clear that Disney is best known for its TV and film properties.

There are so many different companies that you really just have to see it for yourself.

Print Assets

Disney’s print assets are a mix of proprietary publishers, Lucasfilm acquisitions, and Marvel properties.

The mix gives Disney a controlling interest in massive publishing niches, especially comic books, and science fiction novels.

Disney also owns ESPN, which has its own publishing arm for all things sports.

Video Game Assets

Finally, Disney owns a few video game assets.

They’re not huge, but they’re enough to keep Disney mildly competitive and up-to-date in the video game industry (especially mobile gaming).

GameStar, a subsidiary of Disney Interactive Studios, is one of the best-known video game developers bought by Disney.

For even more digital marketing advice, sign up for the email that more than 150,000 other marketers trust: Revenue Weekly.

Media Conglomerate #3: TimeWarner

At the time of publication (11/7/16), it’s possible that ATandT will soon buy TimeWarner for around $80 billion.

If that happens, ATandT will acquire everything below and more.

In the meantime, let’s take a more in-depth look at TimeWarner and what it owns.

Head: Jeff Bewkes

Jeff Bewkes is the CEO of TimeWarner. He makes $32.5 million per year.

That works out to:

- $1.25 million per paycheck

- $125,000 per workday

- $15,625 per hour

As the head of TimeWarner, he’s responsible for all of the following companies.

TV and Film Assets

TimeWarner owns an incredible amount of television and film properties.

The most famous is probably Warner Brothers Animation Studios, which owns properties like Looney Tunes.

Along with that, TimeWarner has joint ventures in The CW and Hulu, along with ultra-niche TV programming for medical waiting rooms.

TimeWarner has also played a big role in comic book adaptations into movies, most notably with Batman.

Last, TimeWarner’s HBO branch achieved global renown with its runaway fantasy drama Game of Thrones, an adaptation of George R. R. Martin’s A Song of Ice and Fire.

Needless to say, TimeWarner’s television and film branches — including joint ventures like Hulu and CW — are doing pretty well these days.

Print Assets

On top of its incredible TV and movies, TimeWarner also controls several big-name print assets, including TIME (obviously).

Investments

TimeWarner has one of the most diverse investment portfolios of any media company.

Their investments act as controlling interests in lots of companies, some of which aren’t related to media.

But no matter what they are, each investment gives TimeWarner a stronger foothold in media.

Video Game Assets

As the owner of DC Comics, Looney Tunes, and tons of other fictional characters, it makes sense that TimeWarner owns a list of accomplished video game studios.

The most well-known is probably NetherRealm, which owns and publishes the controversial (and popular) Mortal Kombat series.

They also own Rocksteady, which is responsible for many of the latest Batman games.

Music Assets

TimeWarner doesn’t own a lot in music, but they have enough to ensure musical support for their other properties.

WaterTower Music might be the better-known business of the two enterprises, but Warner Music Group is still an essential part of the TimeWarner brand.

Internet Assets

Finally, TimeWarner is the first company on our list that also acts as an Internet service provider.

TimeWarner Cable is a major ISP in the United States, and it regularly competes with Comcast.

While its reputation differs from person to person, TimeWarner Cable is wildly profitable, and it’s become a major pillar of TimeWarner’s success.

Media Conglomerate #4: Comcast

Comcast is one of the few remaining Internet service providers in the United States. They also provide cable television and phone services to residential and business customers.

In 2013, Comcast expanded its reach into entertainment by purchasing NBC and pretty much all of its properties.

While most people know NBC as just a television station, it also has major stakes in media companies around the world.

That makes Comcast a major contender in global media, especially in the United States.

Head: Brian L. Roberts

Brian L. Roberts became President of Comcast in 1990, back when the company only earned $657 million in annual revenue.

That may sound like a ridiculous figure to use with the term “only,” but under Roberts’ leadership, the company now earns $74.5 billion annually.

As a result, Roberts is compensated well. He earns $40.8 million per year, which works out to:

- $1.57 million per paycheck

- $156,923.04 per workday

- $19,615.38 per hour

TV and Film Assets

With the acquisition of NBC, Comcast expanded its repertoire of TV and film assets many times over.

TV programming from NBC, cinema from Universal Pictures, and next-gen publishers like AwesomenessTV are all integral to Comcast’s growth and sustainability over the next few decades.

Even their religious niche branch — Big Idea — plays an important part in Comcast’s continued success and increased competitiveness in the media world.

Internet Assets

Most famously, Comcast is known as an Internet provider.

It’s a direct competitor to TimeWarner Cable, and it’s the primary (or only) ISP in dozens of regions in the United States.

Ventures

Last, Comcast has a laundry list of ventures that it launched (or helped launch).

This gives Comcast an interest in dozens of seemingly-unrelated companies as an investor and potentially a future shareholder for the most successful branches.

Media Conglomerate #5: News Corp

News Corp is the media conglomerate best known for its line of Fox companies.

Those include Fox News, FX, and pretty much every other company with the name “Fox” in it.

The company generated more than $33 billion in 2012, and it controls a huge number of print products compared to other media conglomerates.

To get a better grasp of News Corp, let’s check out their CEO Rupert Murdoch.

Head: Rupert Murdoch

While News Corp underwent a split in 2013, Rupert Murdoch remains the head of most of News Corp’s current assets.

With a hand in television, film, music, and print, Murdoch is perhaps the most successful Australian entrepreneur to build an international empire.

As a result, Murdoch earns something to the tune of $22.3 million per year, which is roughly:

- $857,692 per paycheck

- $85,769.20 per workday

- $10,721.15 per hour

TV and Film Assets

News Corp owns the Fox brand, which means they control a borderline-unreasonable amount of media outlets via television and film.

There’s not much more to say about it — News Corp just owns a lot of outlets.

Music Assets

On top of TV and film, News Corp also owns a handful of music assets.

It’s not News Corps’s biggest branch, but it works for their needs, which is typically supporting the TV and film divisions with music (Fox Music).

Wireless Group PLC, on the other hand, is an Irish radio broadcast corporation — one of the biggest in the country.

Print Assets

News Corps’s foundational asset is print.

The company owns hundreds of national, regional, and local newspapers around the world.

The most famous is probably the Wall Street Journal, which fits the mold of News Corps’s focus on financial information.

News Corp also owns HarperCollins, which owns the Christian-niche Zondervan, making News Corp a major player in retail books as well.

Media Conglomerate #6: Sony

Sony is one of the oldest companies on this list since it was founded in 1946.

It also has one of the most recent CEO changes.

In 2012, Kazuo Hirai became CEO of the entire corporation, which might be the most well-known electronics brand on the planet.

But Sony is so much more than an electronics company. They have interests across almost all media industries, and Hirai has helped keep the company current and competitive.

Head: Kazuo Hirai

“Kaz” Hirai started work at Sony Music Entertainment Japan in 1984, and he’s been with the company ever since.

He climbed Sony’s corporate ladder quickly, eventually culminating with his CEO appointment on April 1, 2012.

Since then, Sony has had some problems, but it’s also had some successes. Most notably, Sony recently posted a 666% increase in profit as it launched a turnaround plan. The announcement came almost exactly four years after Hirai become CEO.

At 55, Hirai is one of the youngest leaders of a global conglomerate. But still, he clearly knows what he’s doing.

For his vision, Hirai earns about $4.9 million every year.

Compared to the other CEOs and presidents on this list, that’s pretty modest. But it’s still life-changing money for 99% of the world.

Hirai’s salary breaks down to:

- $161,540.80 per paycheck

- $16,154.08 per work day

- $2019.23 per hour

TV and Film Assets

Sony has a hand in dozens of television and cinema companies. Sony works in production, distribution, and just about every other phase of the television and film processes.

So it makes sense that Sony owns media outlets in lots of different countries, most notably Japan and the United States.

Music Assets

Sony’s music arm is well-known throughout the world.

Their music arms work in both support for their television and film production branches, but they also publish music from artists.

Internet Assets

So-net is Sony’s Internet service branch. It’s only available in Japan, and offers double speeds of Google Fiber for less money.

That makes So-net one of the most generous ISPs in the world in terms of speed.

Non-Media Assets

Sony also owns non-media assets, including a bank, financial holdings, and a creative suite.

These non-media assets don’t publish information, but they certainly play a major role in Sony’s financial success.

Investments

Last, Sony has a portfolio of investments, much like other media companies on this list.

As with our other companies, Sony’s investments give it control over more areas of the media industry without attempting risky projects themselves.

If it fails, Sony only loses a fraction of what they would lose if they had attempted a project themselves.

If it succeeds, Sony has an interest — even a controlling interest — in how the new company develops.

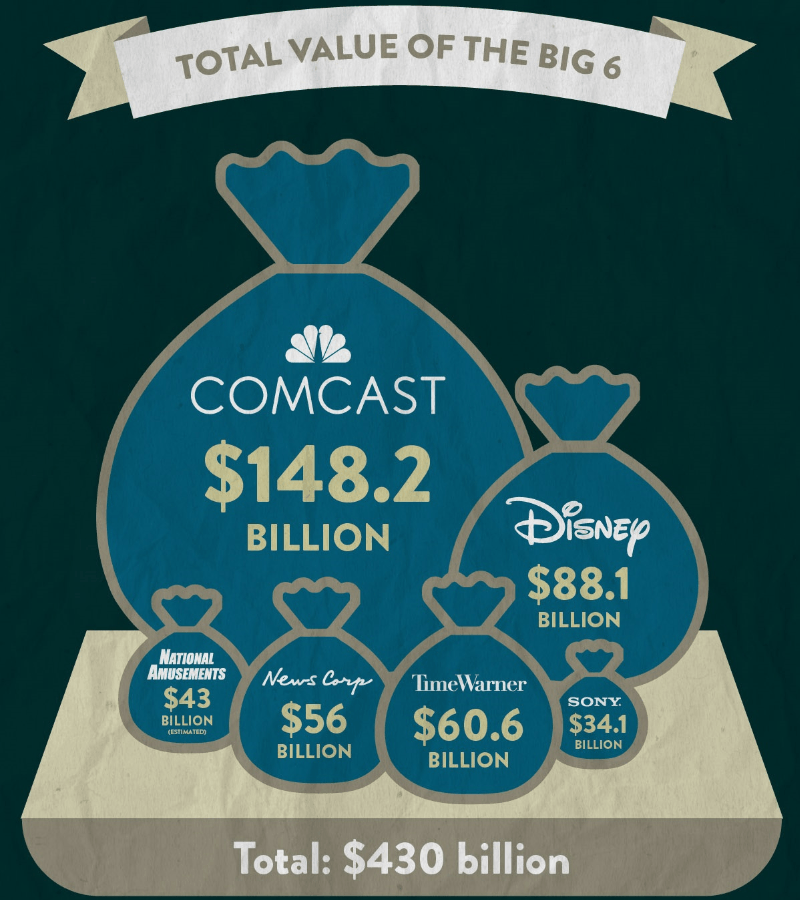

Total Value of Media’s Big 6: $430 Billion

For perspective, if these six companies were a country, they would be the 26th wealthiest country in the world by GDP between Poland ($467 billion) and Nigeria ($415 billion).

These companies are probably here to stay for the next decades — or even centuries.

The only way they’ll disappear is if they’re bought by another megalithic company or run out of business by a major market shakeup that leaves them no time to adapt.

This phenomenon is called “too big to fail,” and it’s often applied to worldwide banks like Citi or Bank of America.

But it also applies here. These companies are profit engines that keep growing.

And when they can’t grow, they buy the smaller businesses that do.

Update: At the time of publication, AT&T is attempting to acquire TimeWarner for roughly $80 billion. The deal is still in negotiations, and the FCC may block it to prevent monopolization.